How to Save Money as a Student in Nigeria (6 Best Tips)

Would you like to know how to save money as a student in Nigeria?

If yes, you are at the right place.

In this blog post, I will be sharing with you some of the best ways to save money as a student in Nigeria.

Honestly, saving money is difficult for most people, especially students.

Learning how to save money means you will no longer lavish your money on non-important things.

Rather, you will be spending your money only on the vital things you need as a student.

Stick with me because after reading this article, you will learn how you can be able to save your money as a student in Nigeria.

How to Save Money as a Student in Nigeria

Here, I want to show you 6 best ways to save your money as a student in Nigeria:

1. Analyzing Your Expenses

Let’s talk about how you can analyze your expenses and take control of your finances.

First things first, let’s get started by tracking your spending.

This might seem tedious, but trust me, it’s worth it.

You can use a notebook, a spreadsheet, or even a budgeting app to keep track of every naira you spend.

This will give you a clear picture of where your money is going.

Next, categorize your expenses.

Think about the different areas where you’re spending money, like food, transportation, entertainment, and housing.

It’s important, to be honest with yourself and make sure you’re including everything.

Now that you’ve categorized your expenses, it’s time to analyze your spending patterns.

Take a closer look at each category and ask yourself, “Am I spending too much in this area? Can I cut back on this expense?”

For example, if you find that you’re spending a lot on takeout food, you could try cooking at home more often or finding cheaper alternatives.

It’s also essential to prioritize your expenses.

Determine what is a need versus a want.

While it might be tempting to buy those new shoes or eat out at fancy restaurants, those are wants, not needs.

Prioritize your essential expenses like housing, food, and transportation.

Lastly, set some goals for yourself.

Maybe you want to save a certain amount each month or pay off a credit card debt.

Having specific goals will help you stay focused and motivated to stick to your budget.

Note, saving money is a journey, not a destination.

It’s important to be patient and consistent in your efforts to cut back on unnecessary expenses and prioritize your spending.

But with a little bit of effort and discipline, you can take control of your finances and achieve your financial goals as a student in Nigeria.

2. Create a Budget

One of the most important steps in achieving financial stability is to create a budget.

Let’s start by considering your income sources.

Do you have a part-time job? Are you receiving allowances from your parents or guardians?

Maybe you have some other sources of income.

Whatever they may be, take some time to list them down.

Now, let’s talk about your expenses. It’s important to be as detailed as possible when listing your expenses.

Don’t forget to include both fixed expenses like rent and tuition fees, as well as variable expenses like groceries and entertainment.

Every little expense counts, so make sure you’re being thorough!

Once you’ve listed all your expenses, it’s time to calculate your total income and expenses for a specific period, such as a week or a month.

This will help you determine how much money you have left after paying your bills.

Now comes the fun part – analyzing your budget and identifying areas where you can cut down on expenses.

Look for expenses that are not essential or that you can reduce.

For example, maybe you can cook your meals instead of eating out or find free or inexpensive activities for entertainment.

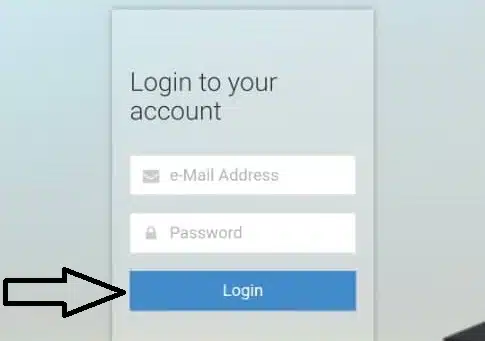

To keep track of your expenses, you can use a spreadsheet or a budgeting app.

It’s important to regularly monitor your budget and make adjustments as necessary.

By creating a budget and sticking to it, you’ll be well on your way to developing good money management habits.

Not only will this help you save money, but it will also set you up for financial success in the future.

So, take control of your finances and start budgeting today!

3. Minimize Spending

The next on our list is all about minimizing your spending.

As a student in Nigeria, managing your finances can be challenging, especially when you’re on a tight budget.

But don’t worry, you can still have some fun and save money at the same time.

One of the best ways to do this is by cutting down on unnecessary expenses.

Here are some tips to help you do just that:

Cook Your Meals: Eating out can be costly, and it’s not always the healthiest option.

So why not try cooking your meals at home? It’s not only cheaper, but it’s also a great way to experiment with new recipes and impress your friends.

Use Public Transportation: Owning a car can be expensive, so consider using public transportation or carpooling instead.

Not only will it help you save money, but it’s also better for the environment.

Shop Wisely: Before making any purchase, do your research, compare prices from different stores, and look for deals and discounts.

You’ll be surprised at how much you can save just by being a savvy shopper.

Cut Down on Entertainment Expenses: There are plenty of fun things to do that won’t break the bank.

Instead of going to expensive movies or concerts, try exploring your community and finding free or low-cost events.

You can also invite friends over for a movie night or game night.

Reduce Utility Bills: Try to conserve energy and water to reduce your utility bills.

Turn off lights and electronics when you’re not using them, and take shorter showers to save water.

It’s a win-win situation – you’ll save money and be kind to the environment.

Reduce Credit Card Use: Credit cards can be helpful, but they can also lead to debt if not used responsibly.

Try to use cash for everyday expenses and only use your credit card for emergencies or larger purchases.

By being mindful of your spending habits, you’ll avoid getting into unnecessary debt.

By following these tips and cutting down on unnecessary expenses, you’ll be able to save money and still enjoy your student life.

Don’t forget, it’s all about being creative and making the most of your resources.

So, are you ready to become a budgeting pro? Let’s do this!

4. Maximize Your Income

Let’s talk about some ways that you can make some extra money and become the boss of your finances.

First up, let’s talk about part-time jobs.

Now, these aren’t your typical, work-all-day-and-night kind of jobs. No way!

These jobs are perfect for students like you, who need some extra cash but also need to hit the books.

You can find jobs at places like a local store or restaurant, where the schedule is flexible enough to work around your school hours.

Next, let’s talk about freelancing.

This one might sound a bit tricky, but it’s just a fancy word for offering your skills to others.

Do you like writing? Can you design cool graphics? Are you a computer whiz?

If you answered yes to any of these, you can offer your services online to people who need them.

It’s kind of like being a superhero, but for making money!

Another way to make some cash is by taking online surveys.

Now, don’t get too excited – these aren’t like the quizzes you take in school.

But they are a way to share your opinion on products and services and get paid for it!

Some companies will pay you to take surveys, so it’s like getting paid to share your thoughts.

If you’re a brainiac in a particular subject, like math or science, you can offer your tutoring services to other students.

This is a fantastic way to help others while earning some extra money. It’s like getting paid for being a super-smart superhero!

Last but not least, let’s talk about selling stuff online.

Do you have some clothes or books that you don’t need anymore?

You can sell them on websites like Jumia, Konga, or Jiji.

This is a great way to make some extra cash and declutter your room at the same time.

Note, there’s no one-size-fits-all when it comes to earning extra money.

But with a bit of creativity and hard work, you can find a way that works for you.

So get out there, explore your options, and become the boss of your finances!

5. Take Advantage of Student Discounts

Are you tired of always living on a shoestring budget?

Well, let’s talk about something that can help you save some money – student discounts! Yes, you heard it right.

Many businesses in Nigeria offer discounts exclusively for students.

So, let’s talk about how you can use these discounts and save some cash.

First off, always carry your student ID with you.

It’s like a superhero ID, but for discounts.

You never know when you might need it, so it’s always best to keep it on you.

Next, check out websites and apps that specialize in student discounts.

Student hub. ng is a fantastic resource that can help you find businesses in Nigeria that offer student discounts.

This way, you won’t miss out on any discounts available to you.

When you’re out shopping, always ask if a store offers student discounts.

You might be surprised at how many businesses offer discounts to students.

This is a great way to save money on things like clothes, textbooks, and tech.

If you’re a student who commutes to school, taking advantage of travel discounts can save you a lot of money.

Many bus and train companies offer student discounts on tickets, so make sure to ask when you’re purchasing your ticket.

Finally, don’t forget about the entertainment discounts!

Many entertainment venues like movie theaters, amusement parks, and museums offer student discounts.

This is a great way to have fun while saving money.

Note, being a student has its perks, and one of them is student discounts!

So always keep your student ID with you, check out websites and apps for discounts, and always ask if a discount is available.

By taking advantage of student discounts, you can save money and have fun at the same time!

6. Making Prudent Financial Decisions

Are you ready to make some smart financial choices?

As a student, it’s important to be mindful of your spending and plan for your future.

But don’t worry, it’s not as difficult as it may seem.

Let’s talk about some ways you can make smart financial choices.

First off, creating a budget can be a game-changer. It may seem boring, but trust me, it’s worth it.

A budget helps you track your expenses and make sure you’re not overspending.

Also, it can be a fun challenge to see how much you can save each month.

Now, let’s talk about those unnecessary expenses.

We all have them, whether it’s a daily coffee run or a subscription you hardly use.

Take a closer look at your expenses and see where you can cut back.

You don’t have to sacrifice everything, but even small changes can add up over time.

Speaking of saving, having an emergency fund is crucial.

You never know when unexpected expenses will pop up, like a broken phone or a medical bill.

By having some money set aside, you can handle these emergencies without going into debt.

If you do have debts, like student loans or credit card debt, it’s important to prioritize paying them off.

It may not be the most fun thing to do with your money, but it will save you in the long run by avoiding high-interest charges.

Now, let’s talk about investing in your future.

It may seem far off, but the earlier you start investing in things like a retirement account, the better off you’ll be in the long run.

Even small contributions can grow over time and set you up for a more comfortable future.

Lastly, don’t be afraid to seek financial advice.

It can be overwhelming to navigate the world of finance on your own, but a financial advisor can help guide you in the right direction and answer any questions you may have.

Making smart financial choices doesn’t have to be boring or scary.

By being mindful of your spending, saving for emergencies, paying off debts, and investing in your future, you can set yourself up for a financially stable future.

So, let’s get started!

How to Build Your Savings Account: Tips & Tricks

Let’s talk about building up your savings account.

I know, I know, it can be tough to save money, especially when you’re a student, but trust me, it’s worth it in the long run.

Let’s dive into some tips and tricks to help you reach your savings goals.

First things first, you need to set a savings goal.

Think about how much money you want to save and by when.

It could be for a down payment on a car or a future vacation, whatever it is, having a clear goal in mind can help keep you motivated.

Next, it’s time to create a budget.

I know budgets can sound boring, but they’re really important.

List out all of your income and expenses and determine how much money you have left over each month.

This will help you see where you can cut back on expenses and save more.

Tracking your expenses is also key to building your savings.

You can use a spreadsheet or an app to track your spending and see where your money is going.

It can be eye-opening to see how much money you’re spending on things like eating out or online shopping.

Another great way to save money is to use automatic savings.

Many banks offer this option, where a portion of your paycheck is automatically deposited into your savings account.

This can help you save money without even thinking about it.

Cutting back on unnecessary expenses is also important.

Do you need to buy a coffee every day?

Maybe you can bring your lunch instead of eating out.

Little changes can add up over time.

Don’t forget to look for savings opportunities too!

There are plenty of discounts out there for students, so take advantage of them.

Buy in bulk to save money and consider second-hand options for things like clothing and furniture.

Lastly, paying off debts can also help you save money in the long run.

By avoiding high-interest charges, you can put that money towards your savings instead.

Note, building up your savings account takes time and effort, but it’s worth it.

By setting a goal, creating a budget, tracking your expenses, using automatic savings, cutting back on unnecessary expenses, looking for savings opportunities, and paying off debts, you can start to see your savings grow.

So, let’s get started and watch that savings account grow!

Benefits of Saving Money as a Student in Nigeria

Let’s talk about the benefits of saving money as a student in Nigeria.

Are you a student in Nigeria? If so, have you ever thought about the benefits of saving money?

I know it can be tough to think about saving when you have so many expenses as a student but hear me out – there are some pretty cool benefits to saving money as a student in Nigeria!

Firstly, saving money can provide you with financial security.

Imagine you suddenly have an emergency or unexpected expense – if you have some savings set aside, you won’t have to stress about how you’ll pay for it.

You can just dip into your savings and take care of it. No stress, no worries.

Saving money can also help you achieve your long-term goals.

Whether you want to buy a car, start a business, or invest in property, saving money can help you get there.

And the earlier you start saving, the more time you have to accumulate wealth and grow your assets. So, why not start now?

By saving money, you’ll also be building good financial habits that will serve you well in the future.

You’ll learn the value of money, budgeting, and financial planning.

And trust me, these skills will come in handy throughout your life.

Saving money can even help reduce stress.

I mean, who doesn’t want less stress in their life?

Financial stress can take a toll on your mental health, so having some savings set aside can provide you with some much-needed peace of mind.

Lastly, saving money can help you become financially independent.

You won’t have to rely on your parents or anyone else for financial support if you have some savings set aside.

Also, there’s nothing quite like the feeling of being able to take care of your expenses.

So, what do you say? Are you ready to start saving some money?

Note, every little bit helps, so even if you can only save a small amount each month, it’s still worth it. Your future self will thank you!

Where Can I Invest My Money as a Student in Nigeria?

As a student in Nigeria, it’s never too early to start thinking about investing your money.

While it may seem daunting, there are quite a few options available to you.

One option is mutual funds.

These are investment vehicles that pool money from many investors and use it to buy a diversified portfolio of stocks, bonds, and other assets.

This can be a good option if you’re looking for a relatively low-risk way to invest your money and don’t have a lot of experience with investing.

Another option is a savings account.

While the returns on savings accounts are typically lower than other investment options, they are a safe and reliable way to earn interest on your money.

Also, they’re usually very easy to set up and maintain.

Lastly, you might consider a fixed deposit.

This is a type of savings account where you agree to leave your money with a bank or other financial institution for a set period, usually ranging from a few months to a few years.

In exchange for leaving your money with them, the bank will pay you a higher rate of interest than you would get with a regular savings account.

Of course, it’s important to do your research and understand the risks involved with any investment option before putting your money into it.

But by taking the time to explore your options and find the right investment for you, you can set yourself up for a brighter financial future.

How Can a Student Save Money Without Spending It?

Being a student can be tough, especially when it comes to managing finances.

But there are ways to save money without spending it.

Let’s dive into some of these strategies!

Firstly, let’s talk about the library.

It’s an incredible resource that is often overlooked.

Instead of buying expensive textbooks or novels, students can borrow them from the library for free!

It’s a great way to save money and still access the materials you need for your studies.

Attending free events is also a fantastic way to save money.

Universities and communities often host free events, ranging from cultural festivals to music concerts.

It’s an excellent opportunity to have fun without spending a dime!

Taking advantage of student discounts is another great way to save money.

Many businesses offer discounts to students, from clothing stores to restaurants.

So, don’t be afraid to ask if there’s a student discount available!

Cooking meals at home is not only a great way to save money but also a great way to improve your cooking skills!

Instead of eating out, students can prepare meals at home, which can be healthier and more cost-effective.

Using public transportation is another way to save money.

Taking the bus or train is usually cheaper than driving a car or taking a taxi.

Also, it’s better for the environment!

Avoiding expensive social activities can be challenging, but it’s necessary if you’re trying to save money.

It’s essential to prioritize your spending and make conscious decisions about what you can afford.

Lastly, selling unused items or participating in paid surveys online can provide extra income.

It’s a great way to earn some money on the side and build up your savings.

To summarize, it can be challenging, but with a little creativity and determination, it’s possible.

And remember, the feeling of achieving your financial goals is priceless!

How Do You Budget Like a Student?

Budgeting as a student can be a daunting task, but it’s crucial for financial stability and success.

Let’s dive into some strategies for budgeting like a student!

Firstly, let’s talk about income and expenses.

As a student, it’s important to determine your income, which can include financial aid, scholarships, and part-time jobs.

Next, track your expenses, including rent, utilities, food, and entertainment.

Understanding your income and expenses is the first step to creating a successful budget.

Creating a monthly budget plan is the next step.

This involves allocating your income towards different categories, such as housing, transportation, and leisure activities.

Be realistic and prioritize your spending based on your needs and goals.

A budget plan is a roadmap to financial success and can help you avoid overspending.

Tracking your spending is also important.

Keeping track of your expenses can help you stay accountable and identify areas where you can cut costs.

There are various tools and apps available that can assist with tracking expenses and sticking to your budget.

Cutting costs is another way to budget like a student.

Take advantage of student discounts, cook meals at home, and avoid unnecessary expenses.

It’s essential to prioritize your spending and make conscious decisions about what you can afford.

Finally, save for future goals.

Whether it’s saving for a trip or paying off student loans, having a plan and working towards a goal can be motivating and rewarding.

Set aside a portion of your income each month towards your savings goals.

To summarize, budgeting as a student can be challenging, but it’s crucial for financial success.

With determination, discipline, and the right tools, anyone can budget like a pro!

What Is the Best Way to Save Money in Nigeria?

Saving money can be tough, but it’s essential for achieving financial security and achieving our goals.

In Nigeria, there are many things we can do to save more money and build our wealth.

Firstly, let’s talk about budgeting.

I know it may not sound exciting, but creating a budget can be quite liberating!

It gives us a sense of control over our finances, and it allows us to plan for our future expenses.

It’s like having a roadmap for our money, and it can help us make better decisions about what we spend our money on.

Now, let’s talk about the challenge of resisting the temptation to spend on immediate wants and needs.

It can be tough, especially when we’re bombarded with ads and social media posts about the latest gadgets or fashion trends.

But reducing unnecessary expenses and avoiding impulse buying is key to saving money.

Think about it this way: every time you resist the urge to buy something you don’t need, you’re one step closer to achieving your financial goals!

Saving a percentage of your income is also crucial.

It may not seem like much at first, but over time, those savings can add up and provide a safety net in case of emergencies.

Also, the satisfaction of watching your savings grow can be a real mood booster!

Investing wisely can also be a great way to grow your wealth.

Of course, it’s important to do your research and understand the risks before investing in any product.

But the prospect of earning passive income and watching your money work for you can be thrilling!

Finally, mobile banking is an excellent tool for accessing savings and investment products.

It’s convenient, secure, and offers a range of options for building wealth.

And who doesn’t love the idea of being able to manage their finances on the go?

So, there you have it – some tips for saving money in Nigeria!

It may not be easy, but with discipline and determination, we can all achieve our financial goals and build a brighter future.

Video Section

Conclusion

For some people, making money is easier than saving money.

This implies that saving money is the hardest part.

One thing is to make money and another thing is to be able to save money.

You could be making a lot of money but if you can’t save properly, you could be vulnerable to going broke.

As a student in Nigeria, you should be able to know how to effectively save your money for relevant future purposes.

In this article, I have shared with you some of the best practices.

Therefore ensure you implement them.

In case you have any questions or inquiries, please indicate them in the comment section and I will reply as fast as possible.

I wish you all the best!

Related Posts:

22 Ways to Make Money Online in Nigeria as a Student for Free

20 Apps to Make Money Online in Nigeria as a Student

How to Make Money Online as a Female Student in Nigeria

Where Can I Invest My Money as a Student in Nigeria?

10 Ways to Survive in a Nigerian University

How to Pack for University in Nigeria (Best Tips)

List of Food Provisions to Take to University in Nigeria

List of Food Provisions for Boarding School in Nigeria